Never Spend Your Money Before You Have It Graphic © inspirationpowerboost.com

Financial Wisdom from Thomas Jefferson

The third U.S. President, Thomas Jefferson, was not only a statesman but also a man of great wisdom. One of his most powerful pieces of advice pertains to personal finance: “Never spend your money before you have it.” This simple yet profound statement holds immense value for individuals seeking to secure their financial future.

Jefferson’s words serve as a reminder to live within our means and avoid the pitfalls of excessive debt. By spending only what we have already earned, we can maintain control over our finances and prevent the stress and hardship that often accompany overspending. This advice is particularly relevant today, when easy access to credit cards and loans can tempt us to spend beyond our current resources.

Practicing financial discipline, as Jefferson suggests, allows us to prioritize our needs over our wants. By distinguishing between essential expenses and discretionary purchases, we can allocate our money wisely and build a solid foundation for long-term financial stability. This approach not only helps us weather unexpected financial challenges but also enables us to save for important goals, such as education, homeownership, or retirement.

Moreover, Jefferson’s advice encourages us to cultivate patience and delayed gratification. Instead of succumbing to the instant pleasure of impulsive purchases, we can learn to save diligently and appreciate the satisfaction of earning and spending our money consciously. This mindset fosters a sense of empowerment and self-reliance, as we take responsibility for our financial well-being.

Jefferson’s wisdom also promotes a more sustainable and fulfilling lifestyle. By living within our means, we can reduce unnecessary stress, improve our overall quality of life, and focus on the things that truly matter, such as our relationships, personal growth, and contributing to our communities. When we are not burdened by the weight of excessive debt, we have the freedom to pursue our passions and make a positive impact on the world around us.

Thomas Jefferson’s timeless advice, “Never spend your money before you have it,” serves as a powerful reminder to practice financial responsibility and live within our means. By heeding his words, we can cultivate a more stable, purposeful, and rewarding life, both financially and personally. As we navigate the complexities of modern society, let us embrace this wisdom and make conscious choices that align with our values and long-term goals.

Thomas Jefferson was one of the founding fathers of the United States of America. As one of the iconic American Presidents, he played a large role in leading the land of opportunity to the future. The future is considered modern-day America. However, the quote is part of the canon written to his granddaughter and another kid bearing his name. Ironically, Jefferson was riddled with debt because of the lavish lifestyle he lived and need to entertain his friends and family – which makes him contradicting to give such advice.

Let’s not focus on the contradicting side but also realize that he was in a better position to advise, due to the experience he went through. It is human nature that we don’t get enough of anything. The predicament puts us in a precarious situation where we want to anticipate the future and put it into account in the present while we have not yet got to the future. The quote is similar to the common saying that you should not count your eggs before they hatch because you do not know how many will hatch.

The future can be anticipated as a way of preparing for it but it should not be the actual outcome that can be brought to the present. Stick to events in the present but anticipate for the future for when you will get there. The gap between the present and the future is unknown because anything can happen in between. Therefore, account for what you have in the present.

The Paradox of Jefferson’s Financial Wisdom

While Thomas Jefferson’s advice to “Never spend your money before you have it” is undoubtedly prudent and timeless, his own financial struggles present an intriguing paradox. Despite his words of caution against excessive debt, Jefferson found himself grappling with significant financial challenges throughout his life.

Born into a wealthy family of Virginia planters, Jefferson inherited a substantial estate and numerous slaves. However, his lavish lifestyle, which included the construction of his iconic Monticello home and the acquisition of vast libraries and works of art, ultimately led to mounting debts. His generosity towards friends and family, coupled with his fondness for entertaining and hosting elaborate gatherings, further strained his financial resources.

Interestingly, Jefferson’s financial woes were not solely a result of overspending. His struggles were compounded by factors beyond his control, such as the decline in the tobacco market, which was a significant source of income for Virginia planters. Additionally, his commitment to public service, including his tenure as president, meant sacrificing income from his personal endeavors.

Despite his financial challenges, Jefferson remained steadfast in his belief that responsible money management was crucial for both personal and societal well-being. He advocated for fiscal responsibility at the national level, warning against excessive debt and advocating for a pay-as-you-go approach to government spending.

This dichotomy between Jefferson’s personal financial struggles and his principled stance on fiscal prudence highlights the complexities of human nature. While he recognized the importance of living within one’s means, the realities of life often presented temptations and challenges that even a man of his stature could not always overcome.

Perhaps Jefferson’s personal experiences with debt and financial hardship further reinforced the wisdom behind his advice. Having witnessed firsthand the burdens of indebtedness, he sought to impart lessons that could spare others from similar struggles. His words serve as a poignant reminder that even the most esteemed individuals can falter when it comes to managing personal finances, underscoring the timeless relevance of practicing financial discipline.

Related Inspirational Quotes

“A wise person should have money in their head, but not in their heart.” – Jonathan Swift

“Money is a good servant but a bad master.” – Francis Bacon

“No money is better spent than what is laid out for domestic satisfaction.” – Samuel Johnson

“Money is like a child—rarely unaccompanied. When it comes, there follows along a tinker, a pander, a groom.” – Walter Savage Landor

“Never spend your money before you have earned it.” – Anon.

😳 What Tinnitus Does To Your Brain Cells (And How To Stop It)

After 47 years of studies and countless brain scans done on more than 2,400 tinnitus patients, scientists at the MIT Institute found that in a shocking 96% of cases, tinnitus was actually shrinking their brain cells.

As it turns out, tinnitus and brain health are strongly linked.

Even more interesting: The reason why top army officials are not deaf after decades of hearing machine guns, bombs going off and helicopter noises…

Is because they are using something called "the wire method", a simple protocol inspired by a classified surgery on deaf people from the 1950s...

This Crazy Off Grid Device Literally Makes Drinkable Water From Fresh Air:

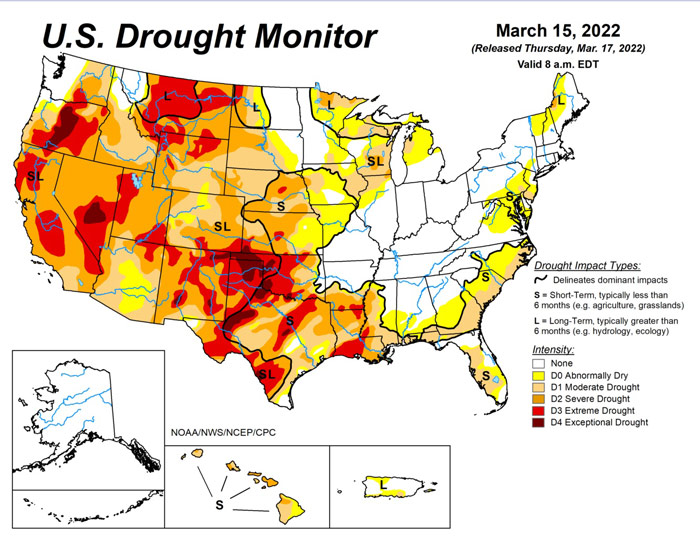

According to NASA, the U.S. is expecting a 100-YEAR LONG MEGADROUGHT.

It's already begun. Ask the farmers in California. They know.

Every survivalist knows that water is of critical importance. You NEED an independent water source that you can count on!

As an interesting "survival rehearsal" - imagine that you turned the tap on right now and nothing came out. How long would you last?

But what if there was another water source literally hidden in plain sight? That's right, I'm talking about the atmosphere!

The amazing thing about getting water from the natural moisture in the air... is that it is ALWAYS available.

This gives you real water security!

Learn more about how to tap into "Nature's secret water reservoir" and stay hydrated when TSHTF!

Watch the video:

Most People Don't Have The Guts To Try This:

An amazing discovery in an abandoned house in Austin, Texas: A lost book of amazing survival knowledge, believed to have been long vanished to history, has been found in a dusty drawer in the house which belonged to a guy named Claude Davis.

Remember... back in those days, there was no electricity... no refrigerators... no law enforcement... and certainly no grocery store or supermarkets... Some of these exceptional skills are hundreds of years of old and they were learned the hard way by the early pioneers.

>> Click here to find out about them now

We've lost to history so much survival knowledge that we've become clueless compared to what our great grandfathers did or built on a daily basis to sustain their families.

Neighbors said that for the last couple of years Claude has tried to unearth and learn the forgotten ways of our great-grandparents and claimed to have found a secret of gargantuan proportions. A secret that he is about to reveal together with 3 old teachings that will change everything you think you know about preparedness: